What Is Bookkeeping? Duties, Pay and how to become

To make sound business decisions, you need good bookkeeping, which provides essential financial information.

Bookkeepers actively manage a company’s financial accounts, ensuring accuracy and ease of review. Their work plays a pivotal role in the smooth operation of successful businesses, which often handle numerous transactions daily, weekly, monthly, quarterly, or annually.

If you are a detail-oriented individual who enjoys working with numbers, a career as a bookkeeper might be an ideal fit for you.

In this article, you will learn more about the responsibilities of bookkeepers, their vital importance to businesses, and their earning potential. You will also explore the pathway to becoming a bookkeeper and find suggestions for cost-effective courses that can equip you with job-relevant skills today.

What is bookkeeping?

Bookkeeping is the process of recording and organizing financial transactions for a business. It helps keep track of income, expenses, and other money-related activities. By maintaining accurate records, bookkeeping enables business owners to make informed decisions and fulfill tax and regulatory requirements. It’s a fundamental step in managing a company’s finances effectively.

Types of Bookkeeping system top of Form

There are two types of bookkeeping: single-entry and double-entry.

- Single-Entry Bookkeeping: In single-entry bookkeeping, each transaction is recorded only once. It’s like keeping a simple list of money coming in and going out. This method is often used by small businesses or individuals with straightforward finances.

- Double-Entry Bookkeeping: With double-entry bookkeeping, each transaction is recorded twice, as both a debit and a credit. It’s a more detailed way of keeping track of money. This method is commonly used by bigger businesses to have a clear view of their financial situation.

In short, single-entry is simple and best for small businesses, while double-entry is more detailed and suits larger businesses to manage their finances accurately.

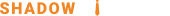

What Does a Bookkeeper Do? Understanding the Role and Importance

- A bookkeeper’s primary role is to record and organize financial transactions for a business or organization.

- They maintain accurate and up-to-date records of income, expenses, purchases, sales, receipts, and payments.

- Bookkeepers use accounting software and tools to record and categorize financial data efficiently.

- They manage the general ledger, which serves as a central repository for all financial transactions.

- Bookkeepers ensure that the company’s financial records are in compliance with relevant laws and regulations.

- They generate financial reports, such as income statements and balance sheets, to provide insights into the company’s financial health and performance.

- Bookkeepers help manage accounts receivable and payable, ensuring timely payments from customers and to suppliers.

- Collaborating with accountants, bookkeepers assist in preparing and filing tax returns accurately.

- Bookkeepers play a crucial role in supporting business owners with informed financial decisions.

- Their attention to detail and accuracy minimize errors and discrepancies in financial records.

- Bookkeepers maintain confidentiality and handle financial data with utmost privacy and professionalism.

- Their expertise is essential for the smooth financial functioning and success of businesses.

- By organizing financial data, bookkeepers contribute to efficient audits and financial reviews.

- Their diligence helps businesses optimize cash flow and maintain healthy financial relationships with stakeholders.

- Bookkeepers may also provide financial insights to help businesses identify cost-saving opportunities and growth strategies.

How to become a bookkeeper

looking for a job that suits your organizational skills and love for numbers? Consider becoming a bookkeeper! Here’s how you can gain the necessary skills to get started.

Explore Bookkeeping Training Opportunities

Taking a bookkeeping course teaches you essential skills for financial reporting, data organization with tools like Microsoft Excel, and book balancing. Some courses, like the Intuit Bookkeeping Professional Certificate on Shadowdiractor.com, offer valuable credentials to boost your resume. While a degree isn’t always required, some employers may prefer candidates with accounting coursework.

Master Essential Bookkeeping Skills

While you take courses and pursue a bookkeeping certification, ensure that you actively acquire the essential skills necessary for your bookkeeping career, as we will explore below:

Technical skills:

- Debits and Credits

- Invoicing

- Billing

- Vendor relations

- Accounts payable

- Accounts receivable

- Data entry

- Spreadsheets

- Payroll

- Financial statements

- Bank reconciliation

- Accounting software

Workplace skills:

- Organization

- Communication

- Time management

- Attention to detail

- Error correction

- Oral and written communication

- Decision making

- Critical thinking

- Interpersonal skills

Get started in bookkeeping

Bookkeepers play a crucial role in maintaining well-organized finances for businesses. If you’re contemplating a bookkeeping career, consider enrolling in a cost-effective and flexible course offered by Shadowdiractor.com. Such training will equip you with the skills needed to excel in this important profession.